How to Send Money in Gcash App

Renz is a digital technology enthusiast. He devotes his time to studying how these platforms can help make things work for us.

How to Avoid GCash Convenience Fees for Cash-in Transactions

In two separate announcements, GCash stated that it will be charging convenience fees for some of its cash-in transactions:

- In May 1, 2020, GCash started charging 2% convenience fee for cash-in via over-the-counter outlets (e.g. 7-Eleven, Touchpay kiosks, supermarkets, department stores, etc.) made in excess of the P8,000 monthly threshold.

- Then recently, GCash announced that beginning July 6, 2020, it will be charging a 2.58% convenience fee on cash-in transactions made via bank cards (Visa/Mastercard).

News regarding this rapidly circulated in social media, causing a major outcry from users who consider the rates excessive.

Avoiding or Minimizing the Convenience Fee

While the convenience fees may indeed sound excessive, as they might cause a dent on our budget, there are still ways to avoid or minimize them. In this article, I'll be sharing some personal tips on how you can do that.

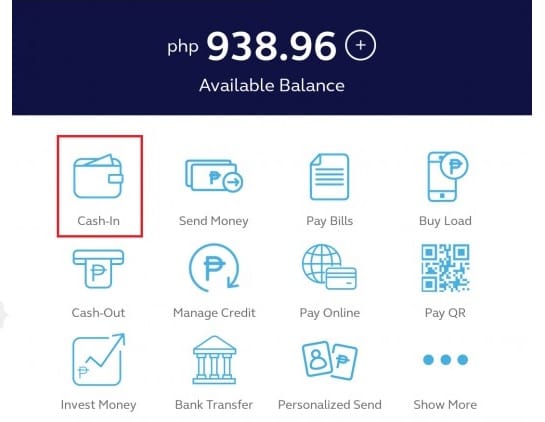

Some GCash cash-in transactions now have convenience fees

Summary of Convenience Fee Charges by GCash

| Cash-In Method | Convenience Fee | Charge for P10,000 cash-in |

|---|---|---|

| Over-the-counter outlets | 2.00% in excess of P8,000 | P40 |

| Bank Cards (Visa/Mastercard) | 2.58% regardless of amount | P258 |

| Online Banking (BPI/Unionbank) | FREE | - |

| Remittance (Paypal/WU) | FREE | - |

First, let's take another look of the current convenience fees charged by GCash. This compilation is as of July 2020. Notice that there are still cash-in options that remain free, so make sure to maximize these options.

Now, before we dive into the ways on how to avoid or minimize these convenience fees, let's try to understand first what happened.

The Rise of e-Wallets in the Philippines

Ever since the pandemic started, a lot of our transactions steeply shifted online. Due to this, e-wallet companies such as GCash experienced a surge in their usage and number of transactions. Recent reports dated May 2020 stated that GCash experienced a massive 700% increase in its transactions.

With such a huge increase in transactions, the number of cash-ins made by users likewise might have increased in the same magnitude. Previously, GCash was subsidizing these charges as a way for them to promote usage and adaptation of the app. However, now that it already hit the critical mass, management might have decided to cease the subsidy. One thing led to another, and soon enough we were hearing this announcement regarding the convenience fees.

How to Avoid or Minimize GCash Convenience Fees

Avoiding the 2.00% convenience fee on cash-in via OTC outlets

The best way to avoid this is to limit your cash-in via this method to P8,000. The only way to know if you have reached the limit is to track it yourself. Hence, whenever you cash in via OTC outlets, write it down in your phone or on paper, and keep track of the total amount.

Take note that the P8,000 threshold is cumulative and not on a per-transaction basis. This means that breaking your cash-in into multiples of P8,000 will not work. For better understanding, let's look at the sample scenario below.

| Date of Cash-In via OTC | Amount Cashed-In | Convenience Fee |

|---|---|---|

| May 1 | P4,000 | None |

| May 2 | P8,000 | P80 (computed as P4,000 plus P8,000 less P8,000 threshold, then balance of P4,000 is multiplied by 2%) |

| May 7 | P2,000 | P40 (computed as P2,000 multiplied by 2%, since we already reached the threshold last May 2) |

| June 2 | P3,000 | None (since threshold has already refreshed) |

Avoiding the 2.58% convenience fee on cash-in via bank card

The simplest way to avoid this fee is for you to resort to cash-in methods that remain free. However, this is difficult since a lot of us receive payroll through banks other than BPI or Unionbank (both currently free if you link your account). Hence, if you are stuck with using your bank card to cash-in, here are ways on how to avoid or minimize the fee.

Read More From Toughnickel

For more clarity, let's break this further into three categories depending on the purpose of why you are cashing-in.

1. Cashing-in to pay bills

If the bills are for utilities (e.g. Maynilad, Manila Water, Meralco), telecommunication (e.g. Globe, Sun, Smart, PLDT) and/or cable (Cignal TV, Destiny, Sky Cable), I suggest that you download Grab and open an e-wallet there. In that app, you can cash-in using your bank card without any charges, and you can use it to pay for the mentioned bills for free.

If the bills are for credit cards, unfortunately, there are no better alternatives yet, so you may need to resort to the old inconvenient ways of paying them such as via banks, department stores, etc. Unless, you do the 'Ultimate Trick" mentioned below.

2. Cashing-in to transfer to another bank

Most of us prefer to have our savings stored in an account, or even in a bank, different from our payroll. With GCash's free 'e-wallet to bank' transfer, people use the app to move funds from one bank to another. This definitely changes with the imposition of the convenience fee. However, the workaround is for you to use another e-wallet which is Paymaya. They also have fees for bank card cash-ins, but it's fixed at P30. Use the guide below to know when to use GCash or Paymaya to do your transfer.

| Amount to Transfer | App to Use | Convenience Fee |

|---|---|---|

| Below P1,160 | GCash | Less than P30 |

| P1,160 and above | Paymaya | P30 |

3. Cashing-in to add money in your GSave Account

GCash has a partnership with CIMB which allows you to maintain an in-app savings account called GSave. This gives out an interest rate of 3.1% per year which explains why a lot of users are depositing their savings here instead of the typical ones. To avoid the heavy 2.58% convenience fee, I suggest that you download the CIMB app, link your GSave account, and use its built-in cash-in function.

Depending on the amount and the bank where the funds will be coming from, the convenience fee ranges from free to about P30. This is way lower compared to the 2.58% fee of GCash.

The Ultimate Trick

I'll be sharing with you a special trick, but this is a bit more complex as it adds an additional step to those mentioned above. However, if you do this right, you can limit the convenience fee to P30 regardless of whether you are paying for bills (credit card included), transferring funds to other banks, or funding your GSave account.

Remember Item 2 above? Yes. That one. All you need to do is to use Paymaya to cash-in, and then use its feature to transfer to another bank. You'll find G-Xchange Inc. among the options, select it, and complete the transfer. You'll get notification shortly in your GCash app saying that you received money, and that your balance is updated. Voila, you may now use the funds for whatever purpose you need it.

The only caveat of this is that it consumes your monthly transaction limit for both Paymaya and GCash, so use this trick wisely.

Wrapping Up

The convenience fees of GCash on selected cash-in transactions may bring unnecessary financial burden, but luckily it can be avoided, or minimized, through the ways explored in this article.

For any clarifications, questions and/or comments, feel free to use the Q&A portion below or drop a message via the comments section.

This article is accurate and true to the best of the author's knowledge. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional advice in business, financial, legal, or technical matters.

© 2020 Renz Kristofer Cheng

How to Send Money in Gcash App

Source: https://toughnickel.com/personal-finance/How-to-Avoid-GCash-Convenience-Fees

0 Response to "How to Send Money in Gcash App"

Post a Comment